“Silk Road 2018 – A new approach to trading”

“Silk Road 2018 – A new approach to trading”

International Conference in Nuremberg on 25 July 2018

by Nils Opel, Nuremberg

On 25 July 2018, a one-day congress “Seidenstrasse 2018 Handeln auf neuen Wegen (Silk Road 2018 – Trading on New Routes)” took place at the Nuremberg Exhibition Centre. The event was organised by the “NürnbergMesse Group”, supported by the Bavarian State Ministry of Economic Affairs, Energy and Technology and the Chambers of Industry and Commerce in Bavaria.

Associates of the NürnbergMesse Group, one of the world’s largest exhibition companies, are the City of Nuremberg and the Free State of Bavaria, each accounting for just under 50%, as well as the Chamber of Industry and Commerce of Nuremberg (IHK) and the Chambers of Crafts in Central Franconia, accounting for around 0.03% each. With 51 representatives, the NürnbergMesse Group is active in 116 countries worldwide. It has 7 subsidiaries in the USA, China, India, Brazil, Italy and Austria.

Focus on Asia and South America

Its international trade fair programme in 2018 demonstrates the company’s international business focus on Asia and South America. 31 events in Nuremberg, 14 in India, 10 in Brazil, 8 in China, 2 in Thailand and just one in Italy, Russia and the USA.

The co-organiser, the Free State of Bavaria, maintains 28 foreign representations abroad. In July 2018, the third Bavarian representative office in China was opened in the central Chinese city of Chengdu; the previous ones are located in Shandong and Shenzen. In 2017, the People’s Republic of China was the second most important Bavarian trading partner. According to the latest figures, China will become Bavaria’s most important trading partner in 2018, as Bavaria’s Minister of Economic Affairs, Franz Josef Pschierer, explained in his opening speech at the congress.

The city of Nuremberg and the southern Chinese city of Shenzen have been twin towns since 1997. Since 2015, a weekly intermodal train with 54 containers has been commuting between Nuremberg and Chengdu. Good reasons to choose Nuremberg as the venue for the first public congress in Germany dealing with the “New Silk Road” project, with around 250 visitors.

This project is attracting much greater interest in Asia. In Hong Kong, for example, a conference has been held every year since three years, attracting 5,000 visitors most recently in June this year. The Chamber of Industry and Commerce of Nuremberg regularly participates in the Hong Kong conferences, representing all German Chambers of Industry and Commerce.

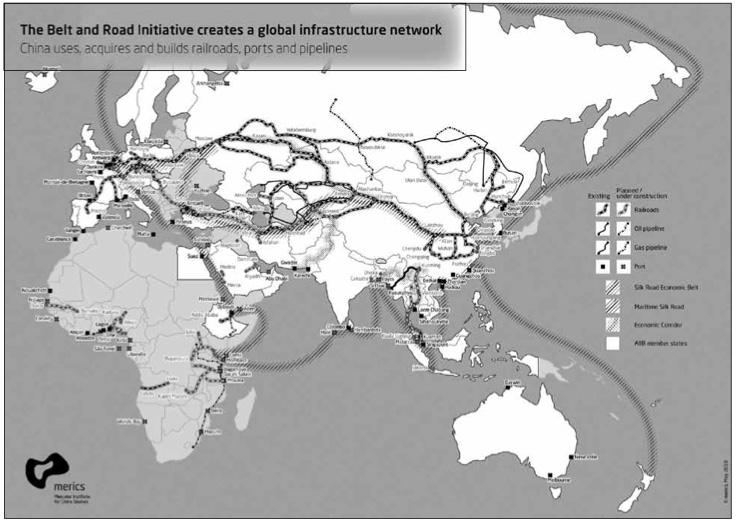

The project “New Silk Road”

The project “New Silk Road” was presented under the name “One Belt, One Road” in September 2013 by China’s President Xi Jinping during his state visit to Kazakhstan (focus on the Belt) and a few months later in Jakarta (focus on the Road). “Belt” refers to the “land connection” between China and Europe. This includes the existing northern railway route via Kazakhstan/Russia and the southern route under construction via Central Asia/Turkey/Western Balkan. There are already destinations in 40 cities in 14 European countries. Since 2008, 8000 freight train journeys have taken place.

“Road” refers to the sea route from the Chinas east coast via the Indian Ocean and the Red Sea to southern Europe. The project is now called the “Belt-and-Road Initiative”, or BRI for short. The Chinese government wants to establish an intercontinental infrastructure network between China and Europe, Africa, the Middle East, South Asia, Central Asia and South East Asia. The region comprises 90 states where 70% of the world’s population live. Economic areas are to be networked and further developed, and structurally weak regions are to be advanced economically. To date, 900 projects have been initiated with projected investments of 900 billion US dollars.

A road of cooperation …

Since the World Bank and the Asia Development Bank (ADB) are unlikely to be able to cover these financial needs, according to Jingqiu Mao, Consul General of the People’s Republic of China in Munich, the Asia Infrastructure Investment Bank (AIIB) was founded on China’s initiative in 2015. In her opening speech at the congress, Ms Mao explained in detail the “Belt-and-Road Initiative”. She pointed out that the initiative was not a strategic instrument servicing Chinese geopolitics. The “New Silk Road” is not a private road of a particular party, but a wide avenue that is built commonly and that should be beneficial to all involved. She explicitly advocated free trade and globalisation, but also emphasised the benefits to the real economy: The “New Silk Road” is a road of cooperation that brings new blood to the economy. The development of the infrastructure should correspond to the actual demands.

… and the opening of China

In view of increasing protectionist tendencies in world trade and the turbulences in the economy, more extensive, higher-qualified and deeper cooperation is necessary. One should not fall back into the age of mutual isolation. The “New Silk Road” is a product of openness and cooperation in times of globalisation. China is a responsible participant and contributor to the existing international system. Ms Mao referred to the importance of the project both for Germany and for China at both ends of the Silk Road: “If both countries jointly can explore the possibilities of the new cooperation and of new areas of trade by the ‘New Silk Road’, this will certainly bring great economic benefits and concrete advantages for the peoples of both countries as well as for the countries along the Silk Road and the people living there”.

A huge growth potential

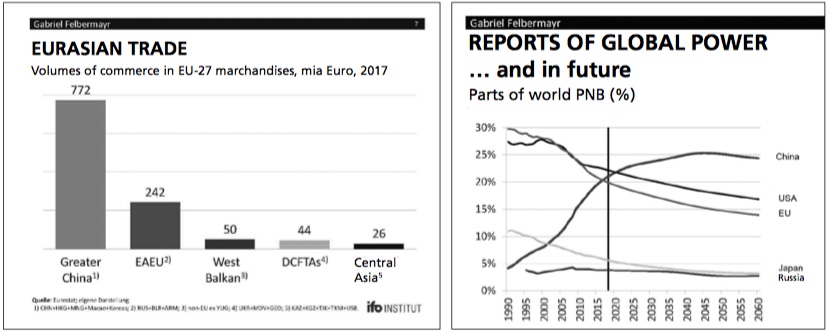

Professor Gabriel Felbermayr, head of the ifo Zentrum für Aussenwirtschaft (external trade) at the ifo Institute for Economic Research in Munich, presented quite comprehensive economic data. Eurasia is a large continent with 4.8 billion consumers in 92 countries and 60% of the world’s economic output, with economic oases on its margins that have economically converged. The disponible per capita income should be about 28,000 euros in Nuremberg in 2018 and 21,000 euros in Shanghai. But the Eurasian space in between is open for economic development. Eurasian trade (here: volume of trade in goods) between the EU and “Greater China” (China, Macau, Hong Kong, Taiwan) amounted to 772 billion euros in 2017, which roughly corresponds to trade between the EU and the NAFTA countries (USA, Canada, Mexico). Growth potential over the next 10 years is forecast at 80% (EU and Greater China), three times as high as growth potential across the Atlantic.

Three quarters of the future global growth up to the first half of the century can be expected in Eurasia. The future will take place in Eurasia and not in the transatlantic economy. In the course of the last 1000 years, China and India each accounted for 25% of world production. In the middle of the 19th century, the sharp decline of China set in, with the simultaneous rise of the West, today’s G-7 states (USA, Canada, Great Britain, France, Germany, Italy, Japan).

In the course of the last 40 years, a trading volume has been achieved that would do justice to the size of China. The OECD estimates that by 2045 China’s share of the world’s aggregated output will have risen to 25 % (in 1990 it was 4 %!). Such a process has never happened before in economic history. The change has just taken place (in 2018 the EU, the USA and China will all be on a par with 20 %), and that is why US President Donald Trump sees China as his strategic adversary.

“The future will be Asian”.

The future will be Asian, and North America will have to give up its leadership in the world economy. According to ADB estimates, the necessary investments in the BRI project will amount to 8 trillion US dollars (2010-2020). That is twice as much as the GDP of the Federal Republic of Germany. President Xi, however, only speaks of 1 trillion. So far 340 billion US dollars have been spent (2014-2017). Serbia, for example, received 4.9 billion US dollars, Greece 3.6 billion, Pakistan 60 billion. China’s investments in the world are about as high as the investments from abroad in China (8-9 % of the flows of investments in the world, about 150 billion US dollars foreign direct investments per year).

China is Germany’s most important trading partner

The vehicle of investment and cooperation with Europe will be the AIIB, founded in 2015, which does not have China as a dominion. China has been Germany’s most important trading partner since 2017 (the trade volume amounted to 187 billion euros in 2017), and the gap to other trading partners will become significantly larger. The transport costs will amount to 9-13 billion euros per year (5-7% of the trade volume). Each per cent reduction in transport costs will generate 3-4% additional trade. Savings over the Silk Road could generate an additional trade volume of 23 billion euros, related to EU-China even 200 billion euros. In the meantime transport costs are more important trade barriers than tariffs. But it will not be just about the trade between the urbanised areas, but also about the development of the Eurasian gap. It will also be about investing trade surplus profitably, not just in US Treasury bonds. “Out of American government bonds, into real investment!”, that makes sense also for Germany. China’s rise will be a fact, Europe will need a Eurasian strategy, it will have to accept realities, seek and reach compromises, and realise opportunities.

Central role of Asian Infrastructure Investment Bank AIIB

Later in the congress, Nikolai Putscher introduced the AIIB. Mr Putscher, as a director of the board of directors of the Asian Infrastructure Investment Bank (AIIB), is responsible for developing the strategic direction and for looking after the controlling and steering functions (previously he worked for the IMF, among others). China has made the offer that all countries could participate in the BRI, and also an offer to develop a bank, which will be there for Asia, but also for other parts of the world. The AIIB is a legally independent institution, now with 86 member countries.

Unlike the BRICS Development Bank, Germany does not see any parallel structures in the AIIB. The aim of the Federal Government will be the preservation of the international financial structure, including China. There shall be no watering down of the environmental and social standards set, for example, by the World Bank, the Asian Development Bank and the African Development Bank. Germany provides considerable resources for the representation of German and EU interests in the AIIB. There is a very open and international discussion in the bank. The business development is surprisingly strong. The AIIB has approved 25 projects worth 4.4 billion dollars in 2 years. (In contrast, the ADB has needed 3 years to get the first project going.) The Chinese share is quite low at 26% and will presumably continue to decline. The bank will not be a Chinese bank, as is spread in the American press. Indeed, it has been designed for Asia and is not a pure Silk Road bank. The bank is quite lean and currently has 450 employees (comparison ADB: 3000, World Bank: 15,000).

Details of the railway connection China-Europe

Uwe Leuschner is Senior Vice President Eurasia at DB Cargo AG and CEO of DB Cargo Russia and has held various management positions in the logistics industry in Russia and China since 1993. In the discussion panel he announced many details regarding the railway connection China-Europe: In 2008, the first “Chinese train” was run between Chongqing and Hamburg. This year about 5000 trains will roll between China and Europe. Growth in the intermodal container concept will be 30% per year. There will be block trains with 41 containers, which will be put together in Russia and Kazakhstan on broad gauge tracks to trains with up to 120 containers. In 2025, the Chinese want to move 3.5 million containers on this way. There will be a project (planned for about 2028/29), to let run high-speed cargo trains between China and Europe as far as to Berlin, every 20 minutes a train with 300 tons at 350–400km/h. Logistically, that will change a lot in the world. There is a pledge from the Chinese side for the financing of the required 6,000 kilometres of new standard gauge tracks. At the moment, the project is stuck, because the Russian government still insists on broad gauge tracks. In the last 20 years, China has created the world’s largest railway system. In the last 10 years, a high-speed network of 22,000 kilometres has been created, and by 2025 it will be 35,000 kilometres.

High importance of the Eurasian gap

The Eurasian gap has the greatest potential for economic growth and investment in the future. The Chinese would have ideas for industrialisation, for example projects on the European external border, such as the largest industrial park near Minsk in Belarus, built outside of China (area nearly 100 square kilometres), where infrastructure and investment are negotiated with governments in the Eurasian Union and are highly desired there. The Chinese would talk about it, and they had contracts signed with Russians and Kazakhs. It is very important to communicate with the Chinese on all levels. Talking to each other and cooperating will be the basis for future developments.

Concrete Silk Road projects

Corinne Abele and Dr Uwe Strohbach presented concrete Silk Road projects and strategies. Corinne Abele has been working for Germany Trade & Invest (GTAI) in Greater China since 1998. (GTAI is the economic development agency of the Federal Republic of Germany). The journalist, graduate economist and Eastern European historian has already been analysing China’s economic process and industry developments for two decades. Dr Uwe Strohbach is regional manager for Central Asia and the South Caucasus at GTAI. Previously, among other things, he was project coordinator for Eastern European research at the Institute for Applied Economic Research in Berlin. Uwe Strohbach is currently working on Eurasian transport corridors and the expansion of transit routes between China and Europe.

For example, renewable energies

Corinne Abele presented developments in the field of renewable energies. China will have installed 770 GW in “New Energies” by 2020. In 2016, China already has overtaken the EU in terms of solar capacity. By 2020, 20% of primary energy consumption will not be of fossil origin. 25% of the electricity consumption is already non-fossil. By 2025, in the automotive sector 25 % of the energy will come from “New Energies” (80 % covered by Chinese brands).

China has the vision of a global power grid. China has invested 123 billion dollars in electricity grids between 2013 and 2018, many in the Silk Road area. For example, in Pakistan, 62 billion dollars are foreseen for projects in hydropower and electricity grids. China has also been active in Brazil for a long time. It is the country’s largest energy producer and largest electricity grid operator. China is investing in ultra-high voltage direct current lines, a technology also mastered by Siemens and ABB. 35,000 kilometres of these lines are under construction and more are to follow. The volume is 250 billion dollars. Over the past 5 years, China has invested 475 billion dollars in the energy sector outside of China. China is now the world market leader in goods for environmental protection, mainly in the field of renewable energies.

The important role of Central Asia

Uwe Strohbach focused on the regions of Central Asia (Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan) and Southern Caucasus (Azerbaijan, Georgia, Armenia). Central Asia has ten times the area of Germany with 72 million inhabitants. However, the GDP is only 6% of the German GDP. Germany’s exports to Central Asia have been growing again since 2017, but there is still very great potential. The same applies to the South Caucasus with 17 million inhabitants, which is half the size of Germany. However, the GDP is only 1.8 % of the German GDP. The states there are hoping for a triad through BRI: modernisation, diversification and exports. Foreign trade between China and Central Asia has increased from 1 billion dollars (2002) to 60 billion dollars (2017) and is expected to amount to at least 100 billion dollars in 2020. Strohbach presented several of the many planned and already started projects (50 in Kazakhstan with 27 billion dollars of Chinese investments and 100 projects in Uzbekistan with 23 billion dollars of Chinese investments). A few examples will be mentioned here:

- Astana-Almaty railway line, about 1,300 km long by 2021, and Taldykorgan-Öskemen railway line, 790 km long by 2017–2020 (Kazakhstan),

- Construction of a gas-chemical and polyolefin complex in Atyrau by 2021 (Kazakhstan),

- Forcing the route China-Kazakhstan-Turkmenistan-Iran (test trains were successful),

- Motorway and railway from Dushanbe (Tajikistan) to Kashgar (China),

- Strand 4 of the Turkmenistan-China pipeline,

- Southern aviation hub Dangara,

- Uzbekistan-Kyrgyzstan-China railway line (Kashgar): 900 kilometres shortening of the East Asia-Central Asia-Europe line,

- Asian star: largest agro-industrial park in Central Asia (international centre for poultry farming and meat products in Kyrgyzstan).

Projects have already been initiated also within Europe

Not only in Central Asia and at the external borders of Europe, but also within the EU, projects have already been initiated. A Chinese company has leased half of the port of Piraeus in Greece for many years and wants to invest here on a large scale. For this purpose also, a freight train connection from the port of Piraeus to Belgrade in Serbia is planned. The Chinese wish to extend the route via Budapest and Vienna to Munich. According to Dr Margot Schüller, China expert at the GIGA Institute for Asian Studies, this project in Greece has already been “approved” by the EU Commission. It is a project of the 16+1 initiative. In this initiative, 16 Eastern and South Eastern European countries are negotiating with China about financing options for infrastructure projects. The project in Greece can be seen in connection with the southern route of the Silk Road mentioned in the beginning. Coming from Germany, this route will also lead via Belgrade via Turkey, Iran and the Central Asian countries Turkmenistan, Uzbekistan and Kyrgyzstan to western China. The tunnel under the Bosporus is currently being extended and expanded to make it suitable for long-distance freight trains. Parts of the route in Turkey and Iran have already been completed. Furthermore, there is already a northern connection between Iran and China, which is about to be opened for freight traffic.

Different from the Berlin-Baghdad-Railway

The southern route of the Silk Road is very similar to the Berlin-Baghdad railway line planned more than 100 years ago. This may be one reason for the recent sanctions against Turkey and Iran. But, back to Europe. How the EU will position itself regarding the BRI project is still unclear. But Dr Skala-Kuhmann, China expert at the German Corporation for International Cooperation (Deutschen Gesellschaft für Internationale Zusammenarbeit, GIZ) said: “Even if Europe and even if Berlin do not express a clear strategy and unfortunately make no clear statements so far on ‘Belt and Road’, […] much more is going on than we might think. ” •

(Translation Current Concerns)