The next crash has been planned

The next crash has been planned

Who wants to profit … and who should pay the bill

by Professor Dr Eberhard Hamer*

Finally the time has come: The HSH Nordbank – the scandalous regional state bank of Hamburg and Schleswig-Holstein – is being sold. Everything about this sale is a scandal: Buyer is the notorious Cerberus, globally operating arms manufacturer and contractor for mercenary armies waging war with American money, for example in the Ukraine, the Orient and Africa, because these wars are unlawful and so brutal that the Americans do not dare to use their own troops because of the legal consequences. So the buyer is morally pretty much the worst thing in the world of all the investors in the market.

Public institutions should not do business with this kind of war and crime organisation. The purchase price amounts to 1 billion euro – however, the sellers (the two federal states of Hamburg and Schleswig-Holstein) also have to take over debts of about 7 billion euros each, i.e. a total of 14 billion. In this way, they will have to make the German taxpayer pay the penalty for the inability of public amateur bankers and of Anglo-finance appointed speculators.

But what circulates among our media is far from an outcry of indignation; on the contrary, the result of these negotiations is being celebrated by German government propaganda. All perpetrators of this financial scandal have made a packet personally, and the former mayor of Hamburg, Olaf Scholz, who was one of those responsible, even successfully applied for the Federal Ministry of Finance.

HSH Nordbank – test case for unrestrained speculation

The HSH Nordbank scandal is a model case for the world’s banks being corrupted by Anglo-high-finance to become unrestrained speculative institutions, for the abuse of currencies and of the financial industry, for the global concentration of capital (dollar empire) and for the lack of restraint and the moral decay of our leading bankers and fiscal policy makers:

– Rulers have known for centuries that the most effective form of “domination” over a country is not military and political, but financial, through money: “He who has the money controls the world.”

Anglo-finance has acquired this power over money by the creation of formally public, but in reality private, central banks such as the FED (Federal Reserve Bank), the BOE (Bank of England), the BOJ (Bank of Japan), or formal-state central banks such as the ECB (European Central Bank) filled with their own people, so that the leading central banks of the Western world are in the hands of a financial syndicate and thus form a self-contained, closed power group – the dollar empire.

“Since money is involved in every business transaction, and as whole civilisations literally rise or fall with the quality of their money, we are talking about a tremendous power operating in secret. It is the power to create illusions that initially seem quite real. That is where the core of FED power lies”.1

The trend towards the centralisation of money and banking not only benefits the largest banks with their power over money and thus the economy, but it also benefits the state, which can use the monetary system (debt) as an alternative form of revenue. “The coalition of state and big banks is the crucial backbone for the centralisation of money and credit.”2

– “Democracy” has become social policy with ever-increasing social welfare benefits for ever-larger voting blocks, funded by loans from international banks. For finance capital, credit is an instrument of domination, especially so as it has its own central banks to provide unlimited money for suchlike US high finance machinations. Money is simply reprinted or electronically multiplied.

Dominating the world by means of the glut of money

“This money glut is the force by means of which US high finance dominates the entire world, subdues it through loans, and subjugates those who have accepted their money permantly.”3

– John Perkins describes how, with counterfeit assessments, excessive loans are pressed into countries, how bribes or threats are used to make governments credit-prone. Those politicians who continue to be reluctant suffer fatal accidents, such as the presidents Torrijos (Panama), Roldos (Ecuador), Allende (Chile) and others.

“The new form of world conquest only consists of the fact that it no longer primarily uses military forces to subjugate peoples, but first presses excessive loans on them, in order to then gain financial and economic control over a people by means of its debts and overdrafts (debt and interest servitude). The result is the same: in both ways, peoples are made permanent tributary and dependent vassals.”4

“The US high finance domination of the world by means of unrestrained printed money, loans and interest rates, is the new form of imperialism, which is built on debt rather than on bayonets and has thus subjected more than 100 countries in the world.”5

“To spare the subjugated states the embarrassment of being called subservient, Washington officially designates its vassals as ‘allies’, which suggests an independence that these countries do not possess.”6

Constantly newly printed illusion money

As a result, all participants are interlinked and interdependent financially: the financial syndicate must constantly create new loans with constantly newly-printed illusion money, while the states must constantly borrow new money (so that by now the highest global debt of all time has been reached). Also the banks are not only brokers of central bank money to the states, but they also speculate with paper money – with ever less restraint and on the basis of the exploding money supply. Yet none of the players can afford to let any of the others default, because a single hole would make the entire financial bubble burst. And this is also the reason why one of the “investors” belonging to US high finance takes back HSH Nordbank, but not its debts, which are split off and socialised, in order to preserve debt bondage.

Pattern for the inevitable crash

– The HSH Nordbank deal is likely to be a model for the inevitable crash of the financial bubble: unscrupulous bankers and fiscal policy makers who are “influenced”, controlled or even bribed by high finance, have long since, in infringement of all bank-, financial and state laws, built up towers of debts and loans (derivative volume 600 trillion dollars, debt 200 trillion dollars, gross world GDP, in comparison, only 80 trillion dollars). Once this bubble bursts, ...

• the necessary devaluation (currency reform) would deprive all private creditors in the world, but would free central banks (especially the FED) from debts,

• The illusory affluence based on pseudo-money in the indebted countries would collapse (Obama: “One must understand that a good part of this wealth was an illusion from the start.”) In this way, the population of debtor states ruined by high-finance would be impoverished, the private banks abused for the explosion of the money supply would be plunged into ruin, and many indebted countries would go bankrupt. Yet high finance will be the prosperity winner of this crash, because in this event they cannot only write off their monetary debt (currency reform), but they have also made sure in good time beforehand that, for example, in Europe, it will not be a national bankruptcy taking place, but a whole EU bankruptcy (through debt, joint liability and financial union, and the stability mechanism ESM) and that the crash, as the 1929 one, will serve to further concentrate assets with the US financial syndicate. The latter will again, as in 1929, increase its real prosperity (minus debt) and be the winner of the new great world financial crash.

Winners and Losers

As with HSH Nordbank, the bankers trusted by the financial syndicate will continue to withstand the collapse of their banks caused by them. Likewise, fiscal policy makers directed by the financial syndicate (Juncker, Draghi, and their troops) will leave the battlefield with pensions secured by taxpayers.

All the corrupt, criminal, and unscrupulous players of the financial casino (high finance clique, central banks, banks, debt states) will emerge from the game as the clear winners. The losers, on the other hand, are the taxpayers of this and the next generation, the owners of medium-sized businesses, employees, savers and pensioners. And once again: outrageous profits were privatised, but all the debt consequences were socialised in “shared responsibility” (Merkel). •

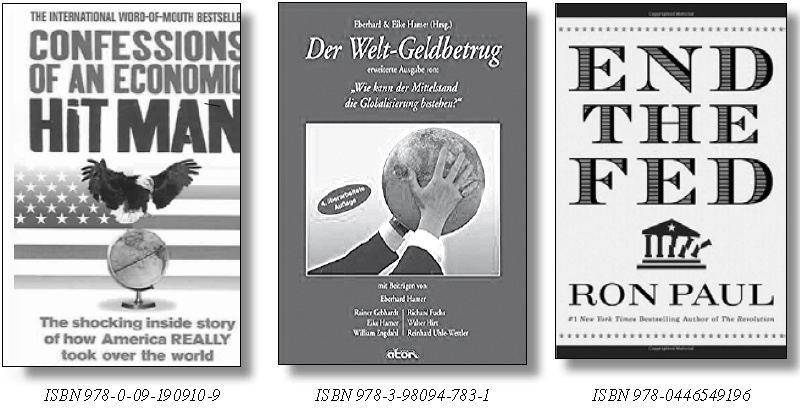

* Prof Dr Eberhard Hamer is founder of the Middle Class Institute Hanover as well as author and publisher of numerous books, including “Was tun, wenn der Crash kommt? Wie sichere ich mein Vermögen oder Unternehmen?” (“What should we do when the crash comes? How do I secure my assets or business?”), 10th edition 2008, and “Visionen 2050. Wohin steuern wir? Trends und Prognosen für Deutschland und Europa”, 2016 (“Visions 2050. Where are we heading? Trends and Forecasts for Germany and Europe”).

1 Paul, Ron, “Befreit die Welt von der US-Notenbank” (“Free the World from the US Federal Reserve”), 2010, p. 8

2 Paul, Ron, ibid, p. 18

3 Hamer, Eberhard, “Der Welt-Geldbetrug” (“The World Money Fraud”), 2007, page 39

4 Hamer, Eberhard, ibid, p. 39

5 Hamer, Eberhard, ibid, p. 49

(Translation Current Concerns)

Goldman Sachs in the Ministry of German Finance

cc. On 19 March the Minister of Finance and Vice-Chancellor, Olaf Scholz, announced that Jörg Kukies (50) will be responsible for European Policy and for Financial Market Policy. Kukies directs along with Wolfgang Fink the US Investment Bank Goldman Sachs in Germany and Austria. Beforehand, he had worked for this bank in London and Frankfurt am Main

since 2001.