Micro-tax – an initiative against systematic risks in the financial casino

by Professor Dr Marc Chesney

(picture wp)

The tax burden is far too high for most households and SMEs. It is poorly distributed and expresses a dysfunction of the state. In a time of digitalisation, taxing so much labour is counterproductive.

The tax system is out of date, unfair and of an exaggerated complexity. The United States’ tax code illustrates this Kafkaesque drift: it consists of 75,000 pages.1

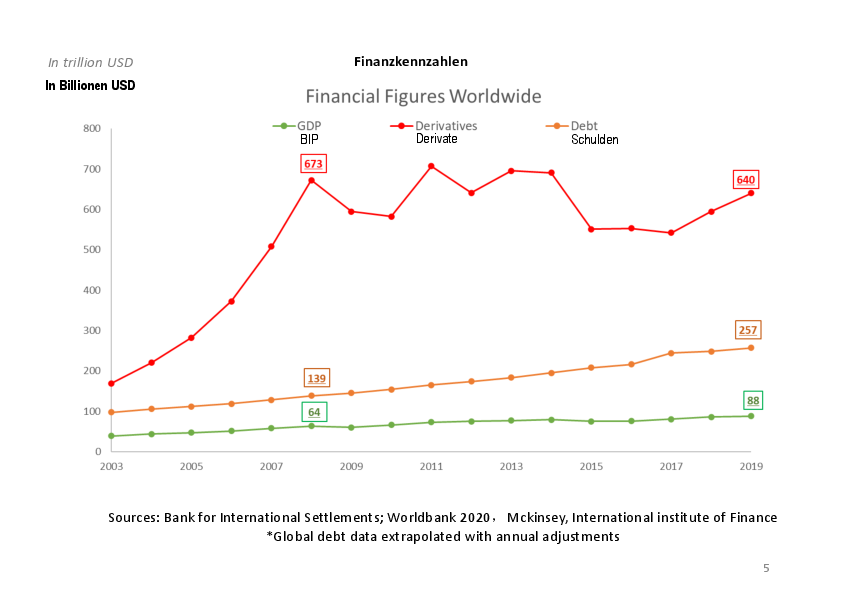

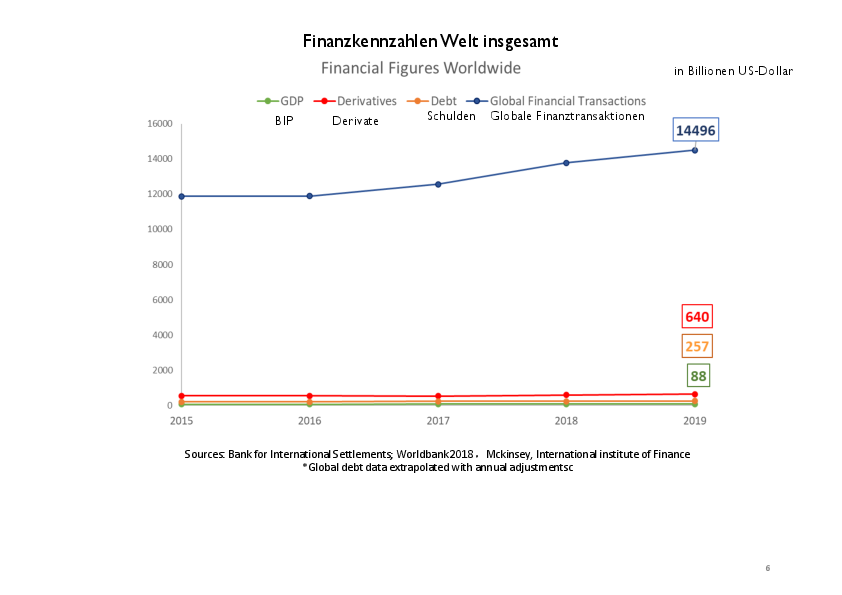

The financial sector has seized power. This marks the failure of democracy. Its dynamic forces are contrary to social and economic development. It imposes costs and growing complexity on society. The tax system should once again undergo an in-depth revision. For this, one thing is decisive: the volume of electronic transactions is excessively high in most countries. In Switzerland and in a number of other developed countries, it is approximately 150 times respective GDPs.

A tax on all electronic payments should be introduced.2

A rate of 0.2 % or even 0,5 % would be low in comparison with the VAT rate, but certainly already too high for the financial lobbies. In view of the financial amounts in circulation, it would represent a true manna for most of the states currently over-indebted.

Switzerland offers a particularly interesting example of the flows such a tax would create. Electronic transactions reached in 2020 an enormous amount of at least CHF 100,000 billion francs.3

A tax of only 0.2 % on every electronic transfer would bring in CHF 200 billion francs, i. e. a little below a third of the Swiss GDP. This amount is higher than the sum of all the taxes collected in this country, estimated at around CHF 145 billion. In short, a low automatic tax on all electronic payments would theoretically allow this country, and most others, to reduce, maybe even abolish, most other taxes! Theoretically of course, as this would result in a reduction in the number of transactions on stock markets, bond markets, Forex markets … it would probably be necessary to increase it to 0.5 % for it to keep its profitable nature. A reduction in the volume of financial transactions would however be very useful as it would also help decrease the unbridled speculation on financial markets. Such a tax would also have the advantage of seriously limiting tax fraud as all electronic transfers are in principle automatically detected and recorded. This issue is currently addressed in Switzerland with the possible launch of a so-called popular initiative.

In the case of France and Germany, as in most developed countries, with a conservative estimate of all electronic financial transactions corresponding to 100 times GDP, a rate of 0.5 % would suffice to generate an amount greatly exceeding all current tax revenues.4

Therefore, a single and simple micro-tax with particularly low costs of collection, should be, on the international level, supported by states, most households and SMIs as it would mean simplification of administrative work and a large drop in taxes. Yet, it has not even been considered! Why? It obviously fails to please major banks responsible for the overwhelming majority of financial transactions. With such a tax, big banks and most hedge funds would pay more taxes than is currently the case, and tax optimisation and tricks of all types would be more difficult to apply!

Such a tax would also help reduce market volatility and would have another positive effect of almost putting an end to financial transactions conducted in milli or microseconds.

It should be noted that such a tax, even introduced in a limited number of countries would already have positive effects. On the one hand, it would stabilise the economy of those countries as casino finance activities would tend to be moved abroad. On the other hand, it would have a knock-on effect on citizens and companies of other countries who would look on with interest and see that it is possible to really reduce taxes and simplify the fiscal system.

Mention should be made that this tax idea differs from the famous Tobin tax. Indeed, it should not be added to already existing ones, but would tend to replace them, by reducing the tax burden of most households and companies, especially SMEs, and by increasing that of big banks which are undertaxed.5

Furthermore, it is not a question of only taxing financial transactions on stocks, bonds or foreign exchange but rather on all electronic payments, including, for example, those concerning supermarket or restaurant invoices and cash machines. •

1 In 1913, it only had 400 pages. This complexity generates huge costs for the American taxpayer. 6.1 billion hours each year are spent trying to understand the pertinent passages of this code and to complete the tax return, which corresponds to a total cost of close to $ 234 billion. Cf. Federal Tax Laws and Regulations are Now Over 10 Million Words Long, Scott Greenberg, 8 October 2015, Tax Foundation.

2 As far as I know this idea was initially introduced in the 1970s by René Montgranier, who presented it as ”the egg of Columbus”. See his book entitled: La Clé de la crise, Éditions économiques financières et sociales, 1985, p. 108-120, as well as the article: Pour une taxe sur tous les mouvements de fonds, Multitudes 3/2011. In the 1990s, Professor Edgar Feige, from the University of Wisconsin, then subsequently Simon Thorpe, director of research at CNRS at Toulouse, as well as Bernard Dupont in Genève, developed a similar idea. Felix Bolliger, in his article “Reinvent the System – Microsteuer auf Gesamtzahlungsverkehr», 2013 also worked on this concept.

3 See annexe 2 of the monthly bulletin of economic statistics of the National Swiss Bank (BNS) of April 2013 “Trafic des paiements dans le Swiss Interbank Clearing SIC», cited by Bolliger Felix. The calculation method used by BNS was altered between January and April 2013, and payment traffic for 2012 therefore dropped from close to CHF 95,000 billion to approximately CHF 30,000 billion (and reached around CHF 45,000 billion in 2020). Transfers between the current accounts of Banks to BNS and their financial trading accounts in the SIC system are from then on excluded from the data. Despite this statistical reduction, financial transfers continue to be extremely high because the SIC system only records a part of the transactions. One has to consider those that on foreign exchange markets (FOREX) concern the franc that add an amount of close to CHF 40,000 billion a year, treated either over-the-counter or on the EBS platform. One also has to consider transfers made inside each financial establishment, operations on derivatives and check that the high-frequency transactions have been taken into account… An estimate of CHF 100,000 billion for the total number of transactions appears to be fairly conservative!

4 See: Un économiste veut remplacer tous les impôts par une seule taxe, Julien Marion, BFM, 30.10.2016.

5 To this regard see the statements made by Gerry Rice, IMF spokesperson in Washington, on 31 January 2013. According to Rice, “The financial sector is undertaxed and must pay an equitable part in order to attenuate the costs of the current crisis […]”

Source: Chesney, Marc. A Permanent Crisis. The Financial Oligarchy’s Seizing of Power and the Failure of Democracy,

Palgrave Macmillan, 2018